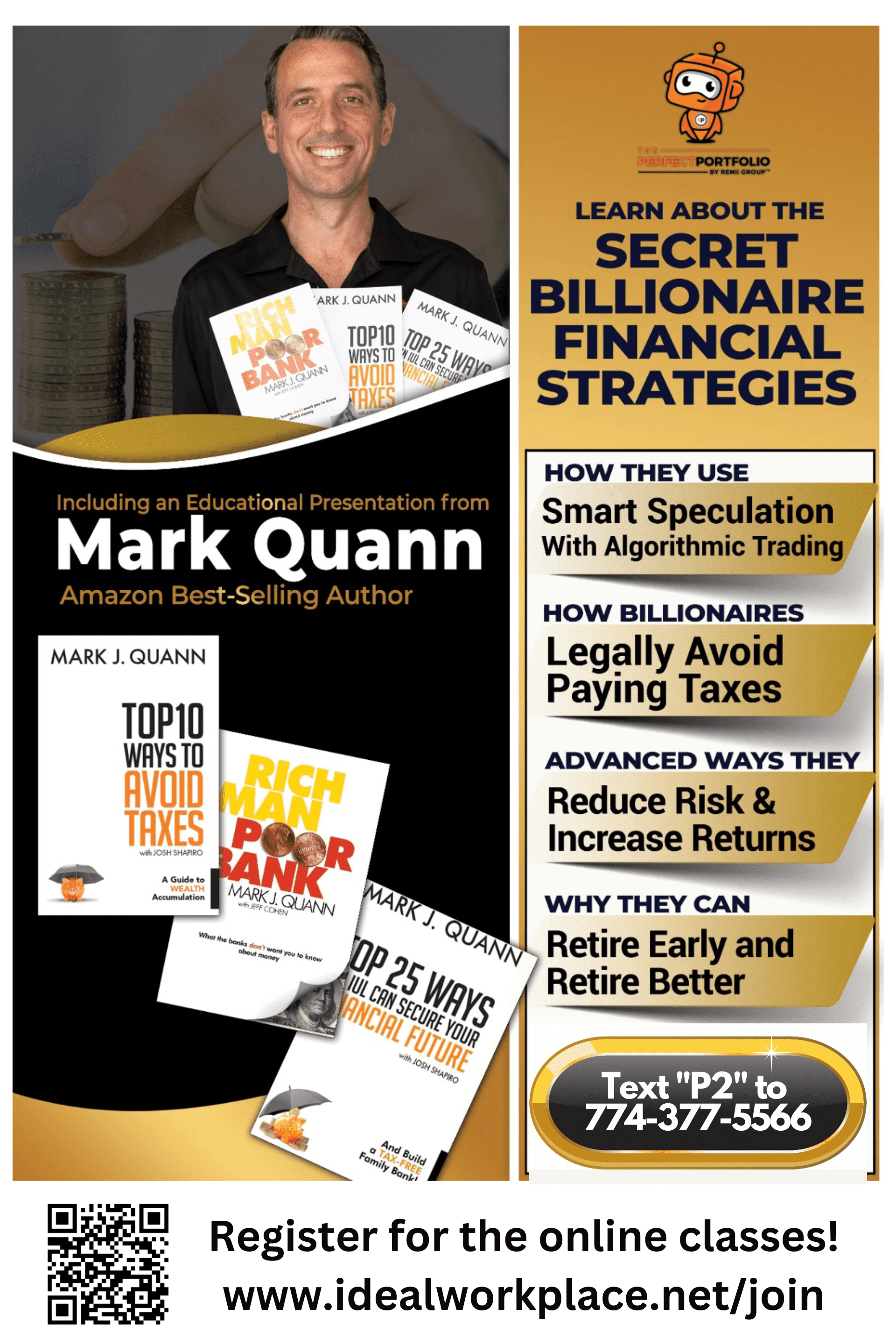

When it comes to planning for your financial future, it’s essential to consider all available tools and products. Indexed Universal Life insurance (IUL), a type of permanent life insurance, has been gaining significant attention over recent years for its unique benefits in financial planning. Drawing insights from the book “The Top 25 Ways an IUL Can Secure Your Financial Future”, let’s delve into the top benefits of IUL policies:

- Tax-free Income: One of the standout advantages of an IUL policy is the potential for tax-free withdrawals and loans.

- Flexible Premiums: Unlike other life insurance policies, IUL offers flexibility in premium payments.

- Death Benefit: Ensure your loved ones are financially protected with a guaranteed death benefit.

- Protection from Market Downturns: While linked to market indices, IULs have a guaranteed minimum interest rate, safeguarding against negative returns.

- Potential for Growth: The cash value has the potential to grow based on the upward movement of stock market indices.

- No Annual Contribution Limits: Unlike 401(k)s and IRAs, there’s no cap on annual contributions.

- Loan Provisions: Borrow from your policy’s cash value without stringent requirements that banks might impose.

- No Mandatory Distributions: Unlike other retirement accounts, IULs don’t require withdrawals at a certain age.

- Liquidity: Access your cash value without penalties or waiting periods.

- Customizable Riders: Tailor your policy with riders like chronic illness or terminal illness benefits.

- Asset Protection: In many states, IULs are protected from creditors, ensuring your wealth is safe.

- Diverse Investment Options: Choose from various indices to link your policy’s performance.

- Cost of Insurance Options: Adjust your insurance costs as per your current financial situation.

- Potential Dividends: Some IUL policies might offer dividends, adding to the potential growth.

- Long-term Care Benefits: Some policies can be structured to provide long-term care benefits, safeguarding against future health care expenses.

- Flexible Death Benefit Options: Adjust the death benefit as per your changing financial needs.

- No Limit on Policy Loans: Borrow as much as the policy’s cash value, unlike restrictions with bank loans.

- Policy Continuation: Even if the cash value drops to zero, some policies may continue without lapsing.

- Supplement Retirement Income: Use the cash value to supplement income in retirement.

- Diversification: Add another layer of diversification to your overall financial portfolio.

- Estate Planning: Efficiently transfer wealth to the next generation.

- Business Planning: Business owners can use IUL for key person insurance, buy-sell agreements, and more.

- Tax-deferred Growth: The cash value grows tax-deferred, maximizing its growth potential.

- Minimal Impact from Withdrawals: Unlike other financial products, partial withdrawals may not significantly affect the death benefit or policy performance.

- Educational Funding: Parents and grandparents can use IULs to fund educational expenses for their loved ones.

In conclusion, Indexed Universal Life insurance, as detailed in “The Top 25 Ways an IUL Can Secure Your Financial Future”, provides a multifaceted approach to financial planning. From wealth accumulation to risk management, this flexible tool offers solutions for a range of financial challenges. As always, it’s critical to consult with a financial professional when considering an IUL or any financial product, ensuring it aligns with your individual goals and circumstances.